Key Takeaways:

- Understanding the nuanced relationship between Bitcoin and traditional economic indicators is essential for informed trading decisions.

- Bitcoin has shown varying degrees of correlation with major stock indices, particularly during periods of economic stress.

- Economic instability and unemployment spikes in 2020 may have sparked increased retail interest in Bitcoin.

- Emergency rate cuts by the US Federal Reserve in March 2020 appeared to lead to a Bitcoin rally, as it correlated with increased liquidity flowing into the asset.

- Rising inflation in April 2021 coincided with a significant Bitcoin price surge, suggesting its potential as an inflation hedge.

- Economic growth periods often correlate with positive trends in both Bitcoin and stock markets, but Bitcoin’s role during recessions is less predictable.

Introduction

In the world of finance, market indices serve as crucial barometers of economic health and trader sentiment. These indices, such as the S&P 500 and Nasdaq, provide a snapshot of market performance across various sectors.

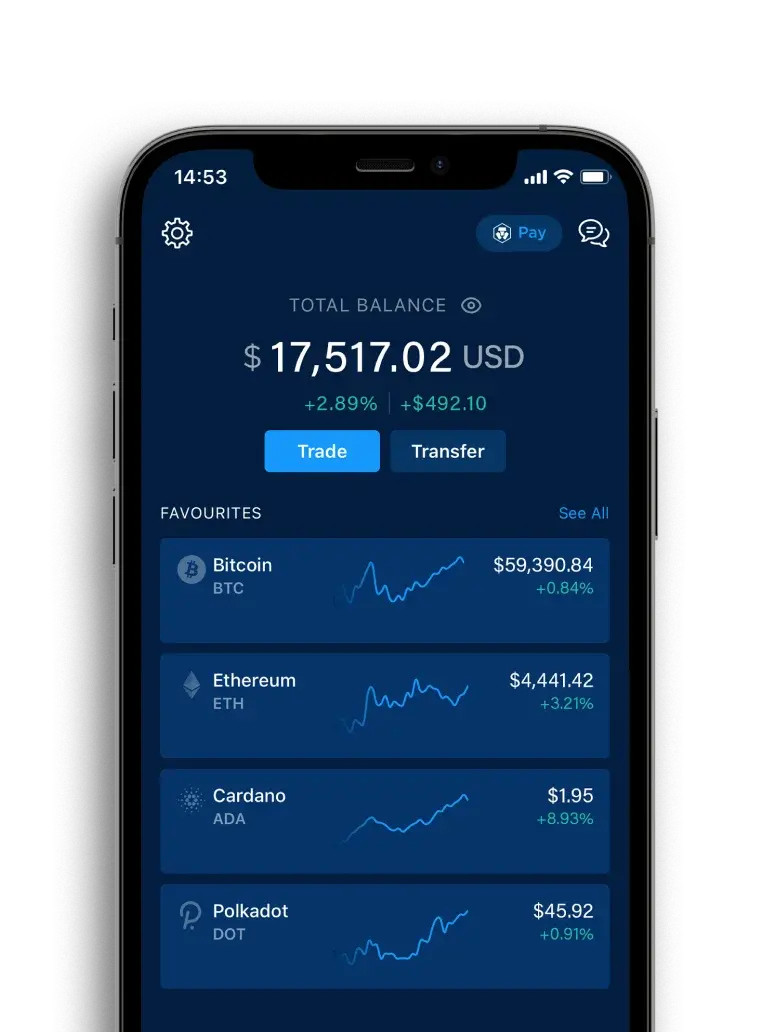

As Bitcoin (BTC) has grown in acceptance beyond the cryptocurrency space, traders and analysts have increasingly looked at its relationship with these traditional financial (TradFi) market indicators. In this article, we explore the intricate dance between Bitcoin and market indices, offering insights through real-world examples.

Market Indices and BTC Price: Are They Correlated?

The relationship between stock market performance and Bitcoin’s price trends has been a topic of intense research in recent years. While Bitcoin was initially touted as an uncorrelated asset, its price movements have shown varying degrees of correlation with major stock indices, particularly during times of economic stress.

Correlation Between the Stock Market and BTC

During periods of economic growth, both the stock market and Bitcoin have shown positive trends, albeit with Bitcoin typically displaying higher volatility. In times of market uncertainty, Bitcoin has seemingly acted as a ‘risk-off’ asset, moving inversely to stock indices. The Nasdaq, home to many tech stocks, has shown a particularly interesting relationship with Bitcoin, often appearing to move in tandem due to similar trader demographics and risk appetites.

Impact of Economic Cycles on Bitcoin

Economic growth periods have generally been favourable for both stocks and Bitcoin, with increased risk appetite potentially driving investments in both. However, during recessions, Bitcoin’s role has been less clear cut. While some traders flee to traditional safe havens like gold, others have viewed Bitcoin as a potential hedge against economic instability.

Let’s look at some examples of how this has played out.

Case Studies and Real-World Examples of BTC/TradFi Correlation

Five real-world scenarios below illustrate the apparent relationship between economic indicators and Bitcoin price movements.

Example 1: CPI Spike and BTC Price Surge

In early 2021, the US Consumer Price Index (CPI) showed a significant year-over-year increase, indicating rising inflation. Contrary to traditional expectations, this coincided with a substantial Bitcoin price surge.

Date: April 2021

CPI Data: 4.2% year-over-year increase (highest since 2008)

BTC Price Movement: Surged from around US$50,000 to nearly $60,000 in the following weeks

This case supports the narrative of Bitcoin as an inflation hedge, with traders apparently seeking alternatives to traditional currencies in the face of rising prices.

Example 2: Fed Rate Cut and Subsequent BTC Rally

When the US Federal Reserve implemented emergency rate cuts in response to the COVID-19 pandemic, Bitcoin, along with other assets, experienced significant volatility followed by a strong rally.

Date: March 2020

Fed Action: Cut rates to near zero (0–0.25% range)

BTC Price Movement: Initial drop followed by a rally from around $5,000 to over $9,000 by May 2020

The rate cut, aimed at stimulating the economy, led to increased liquidity in the market. This excess liquidity found its way into various assets, including Bitcoin.

Example 3: Stock Market Crash and BTC Price Response

The COVID-19 pandemic-induced market crash in March 2020 provided a stark example of how Bitcoin can move in tandem with traditional markets during extreme events.

Date: March 12–13, 2020 (also known as Black Thursday)

Stock Market Movement: The S&P 500 dropped by about 9.5% in a single day

BTC Price Movement: Plummeted from around $7,900 to below $4,000 in 24 hours

This event challenged the notion of Bitcoin as a safe haven, showing that, in times of extreme market stress, correlations between assets can increase dramatically.

Example 4: GDP Contraction and BTC Buying Increase

The economic slowdown in 2020 led to a significant GDP contraction. Interestingly, this period also saw increased interest in Bitcoin from both retail and institutional investors.

Date: Q2 2020

GDP Data: US GDP contracted by 31.4% (annualised rate)

BTC Price Movement: Steady rise from around $9,000 in July 2020 to over $11,000 by August 2020

Economic uncertainty led some traders to seek alternative stores of value, benefiting Bitcoin despite (or perhaps because of) the GDP contraction.

Example 5: High Unemployment Rate and BTC as a Safe Haven

The spike in unemployment rates during the early stages of the COVID-19 pandemic coincided with increased interest in Bitcoin amongst retail investors.

Date: April 2020

Unemployment Data: US unemployment rate reached 14.8%

BTC Price Movement: Steady rise from around $6,000 in early April to over $9,000 by month’s end

Economic instability and concerns about traditional financial systems may have driven some individuals to explore Bitcoin as an alternative investment.

Practical Implications for Traders

Understanding the relationship between economic indicators and Bitcoin price movements can be crucial for informed trading decisions. Below are some practical tips and tools for Bitcoin traders:

Monitor Economic Indicators

1. Keep a calendar of key economic data releases (CPI, GDP, unemployment figures).

2. Use economic calendars available on financial websites to track upcoming announcements.

3. Pay attention to Federal Reserve statements and minutes for insights into monetary policy direction.

Learn more about how macroeconomic indicators affect crypto prices in this article.

Use Economic News in Trading Strategies

1. Develop a framework for assessing how different types of economic news might impact Bitcoin prices.

2. Consider setting up alerts for significant economic data releases or market moves.

3. Be prepared for increased volatility around major economic announcements.

Tools and Resources

Below are macroeconomic analysis websites to bookmark:

Economic Data Websites:

— US Bureau of Labor Statistics

— Federal Reserve Economic Data (FRED)

Crypto-Specific Indicators:

— Crypto Fear & Greed Index: Measures market sentiment

— Relative Strength Index (RSI): Technical indicator to gauge overbought or oversold conditions

How to Use the Crypto Fear & Greed Index

This index provides a 0–100 value, indicating market sentiment:

— 0–25: Extreme Fear

— 26–50: Fear

— 51–75: Greed

— 76–100: Extreme Greed

Traders often use this as a contrarian indicator, considering buying when the market is fearful and selling when it’s greedy.

Understanding the Crypto RSI Heatmap

The Relative Strength Index (RSI) is a momentum indicator used to evaluate overbought or oversold conditions:

— RSI > 70: Potentially overbought

— RSI < 30: Potentially oversold

Traders might use RSI in conjunction with other indicators to identify potential entry or exit points.

Learn about two additional crypto indicators.

Other Resources

For those wanting to deepen their understanding of the relationship between economic indicators and Bitcoin, consider exploring these resources on real-time economic data:

Conclusion

The case studies above highlight the complex and often unpredictable relationship between economic indicators and Bitcoin price movements. While BTC and the macro economy seem increasingly correlated, it is not a clear-cut relationship.

Bitcoin’s correlation with traditional markets can vary greatly depending on broader economic conditions. Economic uncertainty can also drive interest in Bitcoin, but extreme market stress may lead to correlated sell-offs across all assets. Additionally, monetary policy decisions, particularly those affecting liquidity, can have significant impacts on Bitcoin prices.

Understanding these relationships is crucial for making informed trading decisions in the Bitcoin market. By staying attuned to economic indicators and using tools, such as the Crypto Fear & Greed Index and RSI, traders can gain valuable insights into potential market movements.

While no single indicator can predict market movements with certainty, a comprehensive understanding of the economic landscape can provide a significant edge in navigating the volatile world of cryptocurrency trading. Successful trading requires continuous learning and adaptation. Stay curious, stay informed, and always trade responsibly.

Due Diligence and Do Your Own Research

All examples listed in this article are for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, cybersecurity, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Crypto.com to invest, buy, or sell any coins, tokens, or other crypto assets. Returns on the buying and selling of crypto assets may be subject to tax, including capital gains tax, in your jurisdiction. Any descriptions of Crypto.com products or features are merely for illustrative purposes and do not constitute an endorsement, invitation, or solicitation.

Past performance is not a guarantee or predictor of future performance. The value of crypto assets can increase or decrease, and you could lose all or a substantial amount of your purchase price. When assessing a crypto asset, it’s essential for you to do your research and due diligence to make the best possible judgement, as any purchases shall be your sole responsibility.